Posted by Manmohan Kumar and Andrea Schaechter

The sharp increase in fiscal deficits and public debt in most advanced and several developing economies has raised concerns about the sustainability of public finances and highlighted the need for a significant adjustment over the medium term. A recent IMF staff paper on “Fiscal Rules—Anchoring Expectations for Sustainable Public Finances” (attached below) assesses the usefulness of fiscal rules in supporting fiscal consolidation, key design and implementation features, response of rules to the current crisis, and the frameworks that can be implemented as countries emerge from the crisis.[1] The analysis draws on a new data base spanning the whole Fund membership.

Who uses fiscal rules?

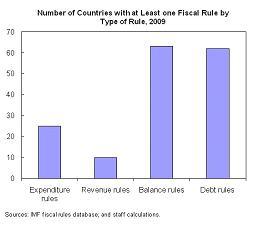

Fiscal rules, defined as a long-lasting constraint on fiscal policy through simple numerical limits on budgetary aggregates, have become more common in recent years. Until the early 1990s, rules were used only in a few countries: public debts accumulated during the 1970s and 1980s, and the recognition that currency unions should be supported by rule-based frameworks led more governments to subject their policies to numerical constraints. As a result, in early 2009, 80 countries had in place national or supranational fiscal rules. Budget balance and debt rules, often in combination, were the most widespread and in place in about 60 percent of countries with fiscal rules.

Fiscal rules: one option for a more prudent fiscal policy

The use of fiscal rules is on average associated with improved fiscal performance. While this association may generally reflect changes in countries’ attitudes toward fiscal rectitude—determining both the improved fiscal performance and the introduction of rules—the spread of rules suggests their contribution to prudent fiscal policies. However, fiscal rules are often introduced to lock-in earlier consolidation efforts rather than at the beginning of the fiscal adjustment. Moreover, fiscal frameworks not involving formal rules but focused on transparent and credible strategies backed by proper fiscal institutions have also provided a viable approach to support fiscal discipline.

Tailoring fiscal rules to country-specific needs

A rule has to be credible with regard to its ability to help deliver the required adjustment and put debt on a sustainable path. But it should also have adequate flexibility to respond to a variety of shocks (including output shocks, exchange and interest rate volatility as well as commodity price fluctuations). Simulation analysis shows that among the various types of fiscal rules (budget balance, debt, revenue, and expenditure rules) cyclically adjusted balance rules are superior in dealing with output shocks, but cyclical adjustment requires care since it could pose challenges as to accurate assessment of the cyclical position, in particular during times of high economic uncertainty, and communication with the public. An independent fiscal agency or a fiscal council could play a useful role in supporting the technical requirements for such rules and in monitoring their implementation. The paper also discusses the issue of coverage of rules, the extent to which rules should respond to past deviations, and the importance of effective monitoring and enforcement procedures.

Fiscal rules and the crisis

The recent crisis has strained the fiscal rules, with about a quarter of the countries with national rules modifying them or putting them into abeyance. Looking ahead, in a period of large consolidation needs and unusual uncertainty, the paper suggests that an early implementation of a new rule or a rapid return to the fiscal targets implied by an existing rule may not be appropriate, as the required speed of adjustment may be excessive. During the transition period, a parametric approach, focused on medium-term targets, is preferable. However, it may be helpful to design and announce early-on a credible rule-based framework, and a timetable for its implementation or for a return to the existing rule-based path.

________________________________________________________________________

[1] The paper was prepared by a staff team led by Manmohan Kumar that included Emanuele Baldacci, Andrea Schaechter, Carlos Caceres, Daehaeng Kim, Xavier Debrun, Julio Escolano, Jiri Jonas, Philippe Karam, Irina Yakadina, and Robert Zymek.