Posted by Ian Lienert and Alexandre Chailloux[1]

Two important objectives of cash management are to minimize idle balances in government bank accounts and to maximize returns on excess balances in the main treasury operational account held at the central bank. Stabilizing the size of treasury balances also has the merit of simplifying central banks’ liquidity management.[2] To that end, modern cash managers avail themselves of safe financial market instruments, especially reverse repos.

But what happens when financial markets are in turmoil and the repo market evaporates? What should modern cash managers do when one of their main instruments for managing daily surpluses or deficits of government cash becomes unavailable? This blog examines what happened in France during 2008–09 and how the cash management agency (Agence France Trésor or AFT) reacted to the unusual circumstances brought on by financial market turmoil.

What are repos and reverse repos, and how do government cash managers use them?

A repo, more fully known as a Sale and Repurchase Agreement, is used when an entity has short-term cash needs. In a repo, the borrower agrees to sell a security to a lender and to buy the same security from the lender at a fixed price at some later date. The transaction results in a transfer of cash to the borrower in exchange for the legal transfer of the security to the lender. In a repo, the cash transaction is combined with a forward contract, which ensures repayment of the short-term loan to the lender and the simultaneous return of the collateral to the borrower. The difference between the forward price and the spot price is the interest on the loan, while the settlement date of the forward contract is the maturity date of the loan.

Reverse repurchase arrangements are used when government cash managers have surplus cash: they acquire a security from a borrower in return for cash. Reverse repos have become a favorite instrument of some modern government managers,[3] who are assigned the task of ensuring that any temporary cash deficits are plugged and any temporary cash surpluses are invested for short-term periods. Unlike private sector financial market participants, who may take large risks in order to maximize short-term returns, government cash managers are prudent. Any short-term placements of idle funds have to be virtually free of risk; it would be most embarrassing for the cash manager, acting on behalf of the government, to “lose” taxpayers’ monies by inappropriate short-term placements.

Unlike repos based on, say corporate debentures, repos backed by government securities are perceived to be a completely safe instrument, as the collateral is a government security that is free of default risk (at least in advanced OECD countries). Repo maturities can be as short as overnight, up to one week or a few months. Reverse repos are ideal for active cash management when targeting an optimal contingency buffer balance in the government’s main operational treasury account.

Cash management and repo market conditions during the financial crisis

Cash management has become particularly refined in countries such as France, Sweden, and the United Kingdom. Their cash managers are active participants in repo markets involving government securities. In Sweden, there is considered to be no necessity for a continuous contingency buffer in the treasury single account (TSA) at the central bank. Therefore, in order to meet the objective of maintaining a zero overnight balance in the TSA, repo operations are performed several times during the day to ensure suitable returns are earned on surplus government cash holdings (and cash shortages are met efficiently). In France and the United Kingdom, cash managers usually target a positive end-day balance, which is very small relative to the total value of daily transactions.

Although European countries’ cash managers are active in repo markets, the total value of their transactions is not large. Even on days when government cash managers are particularly active, their total share in all repo markets may only be about 5 percent of the total market (this percentage relates to the share of the total nominal value of repo markets, including those backed by risky collateral that government cash managers would not entertain because of their unsecured nature).

In 2008, repo markets throughout the world were shaken, as part of the crisis in financial markets. The extensive use of repo operations by broker-dealers and investment banks to build leverage created concerns about some counterpart’s ability to repay some of their repo obligations. The loosening of risk mitigation instruments in the run-up to the crisis was followed by a brutal awakening to the riskiness of underlying collaterals. Adverse repricing of collateral and increasing haircuts[4] towards counterparts perceived to be risky, generated a quasi-panic on the repo market, including in the most secured segment of the market. In addition to counterparty risk surge, collateral-rich banks started to withdraw from the market, hoarding government securities in view of a hypothetical need to access central banks emergency lending facilities.

Impact in France and AFT’s cash management operations

Towards the end of 2008, the general collateral market in France ceased to operate normally. As the government’s cash manager, AFT had to adapt to the evolving situation. Before examining the unusual situation, we provide some background on France’s TSA.

In France, the State’s cash position is the balance of all financial movements carried out by some 5,000 principal public accountants, who each are responsible for managing one or more transaction accounts. As of December 31, 2008, the TSA was made up of 6,840 transaction accounts. These are subaccounts of the main AFT operational account held at the central bank, la Banque de France, which centralizes transactions in real time and posts them in the TSA. The transactions posted to the TSA are comprised of:

· Central government (“State”) budget transactions, such as tax and nontax revenues, current and capital expenditure;

· Treasury correspondents’ transactions, that is the transactions of bodies that are required to deposit their funds with the central government, notably local governments, and national and local public entities;

· AFT’s transactions relating to medium- and long-term financing for the central government and management of its cash holdings (redemption of bonds at maturity, interest payments, margin calls, debt issues, buybacks).

AFT actively manages the TSA on a day-to-day basis. As in all countries, the central government’s in-year cash flows are characterized by the mismatch between revenues and expenditures. Tax revenues, along with inflows and outflows arising from debt management, are clustered around a few key dates. The pattern of government cash flows has recently become more uneven because of large debt transactions, following the surge in issuance volumes associated with rising fiscal deficits.

Based on the cash flow patterns and notifications of cash transactions, AFT:

· Decides on the issuance amount of fixed-rate treasury bills;

· Determines the proportion of the cash deposited in the TSA by treasury correspondents that the central government will use for cash management;

· Invests temporary cash surpluses in the interbank market in the form of unsecured loans, reverse repos of government securities, and loans to certain treasuries in the Euro zone (Belgium, Finland, Netherlands, Germany) with which it has cash exchange agreements. (In 2008, AFT carried out 9,557 transactions on the interbank market with its banking partners.)

· Contracts unsecured loans or loans from treasuries in the euro zone with which it has cash exchange agreements.

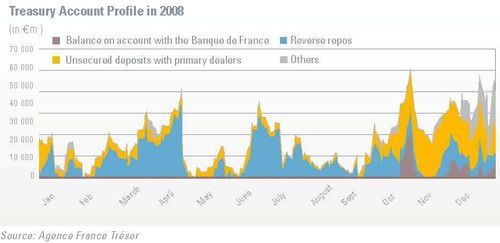

In 2008, AFT had to adjust its cash management and short-term investment policy to disruptions in financial markets. During the first few months, there was the usual hump of the April payment coupon (with a peak of around 40 billion Euros of repo outstanding), then the July payments, and then the October peak, which is always the largest in France (as coupon dates are standardized on the French debt so that all BTANs (midterm notes) either pay an April or November coupon).

During the last quarter of 2008, the composition of treasury balances changed dramatically. Exceptionally, AFT was unable to maintain its unremunerated cash buffer balance at the Banque de France at or below the target level of 100 million Euros (see purple section of chart below). And instead of lending through secured instruments, notably reverse repos, there was an unprecedented expansion of unsecured deposits with primary dealers[5] (yellow sections of the below chart).

Was France’s cash management agency breaking its operating rules and participating in the unsecured interbank market because of rate of return considerations? Or was there discrete liquidity support to financial institutions running short of collateral? AFT’s annual report for 2009, from which the above chart is taken) indicates that it was neither of these two reasons.

What happened was the repo-based money market had ground to a halt, for at least two weeks. Faced with uncertainty, banks retained as many government securities as possible to improve the overall quality of their balance sheet assets. Since government securities, which are the only collateral that AFT accepts for repo operations, became rarer, it became difficult for AFT to use this method to invest any surplus cash it had in the TSA. Primary concerns of the French authorities at the time were to ensure sufficient liquidity in the financial system and restore confidence in money market participants. If the government cash managers were seen to be denying deposits to commercial institutions unable to provide effective collateral, underlying systemic difficulties may been seriously exacerbated.

AFT had little choice but to continue to lend its surplus cash in the disrupted environment. A decision had been taken to frontload massively debt issuances of thirteen-week bills from October 2008 in order to pre-fund banking sector support measures that were due to be paid in early 2009. This large inflow of cash needed to be remunerated and, at the same time, re-introduced to the banking system as desperately needed liquidity. Prudence remained necessary however and, whilst reverse repos could not be used, abnormally large cash deposits were left in the TSA at the central bank during that period, especially in late October.

During November 2008, the size of unsecured deposits on the interbank market rose very significantly, as reverse repo operations collapsed. Since then, the repo market has begun functioning again. Data for AFT’s repo operations for the first 10 months indicate that there was a return to the more usual seasonal pattern in reverse repo operations. However, the level of deposits in the banking system remained higher than in 2008, although it is not possible to discern, from published data, how these deposits were split between commercial banks and Euro-zone central banks with which AFT has agreements.

Commercial banks deposits by government cash managers are inherently risky because of the lack of collateral. However, in France, AFT minimizes these risks in several ways. First, it trades only with selected reputable financial institutions—primary dealers—chosen carefully after periodic review. [6] Second, AFT establishes cash limits for each individual bank. Third, AFT does not make unsecured loans to all selected primary dealers, but only to the best rated banks. This rate is not the credit rating published by international credit rating agencies, but a rate determined by AFT itself for its primary dealers. These safeguards prevent AFT from placing temporary surpluses in less secure financial institutions.

In summary, the repo market disruptions impacted AFT’s activities severely in the final quarter of 2008. Market blips that characterize cash managers’ activities are usually of very short duration (a few days), but the collateral hoarding by banks and collapse of the repo market has an impact of longer duration, especially in November 2008.

--------------------------------------------------------------------------------

[1] Alexandre Chailloux is a senior economist in the IMF’s Monetary and Capital Markets Department. This blog has benefited from helpful comments from colleagues Guilhem Blondy and John Gardner (Fiscal Affairs Department).

[2] In advanced countries, changes in the balance on the treasury’s main operational account (and more generally, public sector accounts with the central bank when no Treasury Single Account has been put in place) represent the most volatile component of the autonomous factors of banking sector liquidity. Cash management operations aimed at maintaining a stable amount at a given threshold is most useful for monetary management, and help central banks to achieve better control of short-term interest rates. Agreements between central banks and government cash managers may be based on the following incentive structure: balances up to the threshold are remunerated at the key central bank (monetary policy) rate, while balances in excess of the threshold are remunerated at the deposit rate (i.e., 50 or 100 basis points lower).

[3] Repos—as opposed to reverse repos—are generally not used. This is because government cash managers do not hold a stock of government securities (c.f., the capital holdings of the central bank, for example) to use as collateral. Government cash managers normally sell treasury bills directly into the market for cash management purposes.

[4] In a repo operation the haircut (or initial margin) is the amount of over-collateralization that is required contractually by the lender to protect itself against the risk of a cash shortfall in case of realization of the collateral. A 10% haircut means that the lender will require the transfer of 110 of collateral at market value, to cover a cash loan of 100. Haircut calculations are collateral specific, and based on the market risk features (volatility, duration) of the underlying assets used as collateral, and assumptions of liquidation lag. Sometimes haircuts are adjusted to reflect the credit risk of the counterpart. During the course of the operation, the risk cushion created by the initial haircut is adjusted to offset changes in the market value of the collateral (margin calls).

[5] The AFT generally uses unsecured loans only in the very specific context of an agreement with other Euro-area treasuries, whereby unsecured loans can be granted to other debt management offices that show coincident borrowing needs. Unsecured loans to commercial banks were not intended to be performed in practice.

[6] In July 2009, 18 banks were selected for a new three-year renewable term, in compliance with AFT’s Charter. The list includes 4 French banks, 8 European banks, 5 American banks and one Japanese bank.