Posted by Tim Irwin[1]

There’s a lot talk these days about government balance sheets. You can find them mentioned, for instance, in the April 2016 editions of the Fiscal Monitor, the Global Financial Stability Report, and the World Economic Outlook. The issues discussed there include the sensitivity of government balance sheets to currency depreciation, their links to the balance sheets of banks, and the value of testing how they would stand up to severe economic shocks.

But how much progress have governments made in actually compiling and publishing their balance sheets?

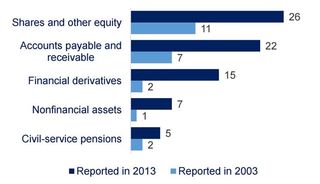

The article “Dispelling Fiscal Illusions,” an early version of which is available as an IMF Working Paper, investigates the progress made by the 28 countries that were classified as advanced when the IMF’s accrual-based Government Finance Statistics Manual (GFSM) 2001 was introduced. It does this partly by looking at the changes in the number of central governments that publish accrual-based financial statements including a balance sheet (8 in 2003, 17 now). But it also looks at finer-grained changes in the reporting of particular assets and liabilities to the IMF for publication in the Statistics Department’s Government Finance Statistics Yearbooks.

Some of the results are depicted in the figure above. As that figure shows, almost all the 28 countries now report an estimate of their investments in shares and other equity, whereas only 5 and 7 countries, respectively, report nonfinancial assets and liabilities for civil-service pensions. Even in these two cases, however, there has been an improvement in the past decade.

One reason for wishing for faster progress is to dispel the fiscal illusions that arise when assets and liabilities are off balance sheet. It would be naïve, however, to think that reporting all the assets and liabilities provided for by the GFSM 2001 would completely dispel such illusions—or that this could be achieved by following instead the revised edition of the GFSM published in 2014, or International Public Sector Accounting Standards. Many years ago, US municipalities started to adopt private-sector-like accounting that solved some of the problems caused by the standards they had previously used, but didn’t require the recognition of liabilities in relation to financial leases. Leases therefore became very popular. At the time, the journalist Richard Greene noted that following a new set of accounting standards was “sort of like learning a foreign language—you tend to pick up the swear words first.”

[1] Tim Irwin is a consultant and a former staff member of the IMF and World Bank.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.