By Fabian Bornhorst and Teresa Curristine1

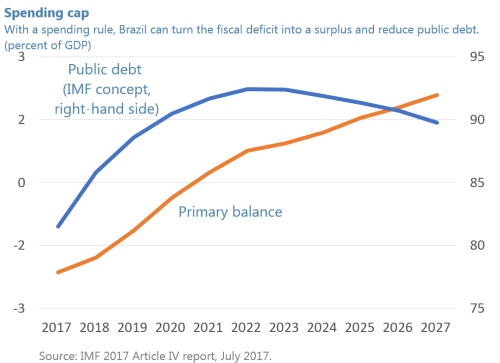

Brazil is emerging from a deep recession. While the country is expected to register positive growth in 2017, the crisis left deep scars in Brazil’s public finances. From 2013 to 2016, the primary budget balance, which excludes interest payments, tumbled from a surplus of 1.7 percent to a deficit of 2.5 percent of GDP, and public debt increased by almost 20 percentage points. The impact of the downturn was magnified by long-standing structural fiscal problems.

To restore fiscal health and boost the credibility of fiscal policy, the Brazilian government introduced important reforms. The central element is a new spending rule, which was included in the Brazilian Constitution in December 2016. This rule limits the growth of federal spending to the rate of inflation. But successful implementation of this rule will require structural reforms and institutional and procedural changes in the management of public finances.

Restoring debt sustainability

Brazil needs to push ahead with structural reforms to stay within the expenditure limits established by the rule. To address the underlying causes of expenditure growth, it is essential to tackle unsustainable spending mandates, including social security. Total social security expenditure in Brazil is among the highest in the world at about 11.3 percent of GDP in 2015—a figure especially high for a country with Brazil’s demographic structure. A proposal to reform social security was submitted to the Brazilian Congress last December.

Other measures are needed to comply with the spending cap in the future, such as reviewing fast growing mandatory expenditures and indexation practices. At the same time, a more flexible budget can protect, or better increase, much needed public investment to close the infrastructure gap. While expenditure reform holds the key to medium-term fiscal sustainability, revenue measures, such as reducing the number tax exemptions, can bring down the fiscal deficit faster.

Successful implementation of these reforms would lower the expenditure-to-GDP ratio, and, as revenues recover, reverse the public debt path. The IMF’s annual report on Brazil’s economy projects that under such a scenario, public debt would peak at above 90 percent of GDP in 2022 and then start to decline.

Supporting the fiscal rule

International experience shows that to implement expenditure rules governments need to embed them in their budget process, adopt a medium-term approach, and improve financial reporting to enable monitoring of compliance with the rule. To successfully implement the new rule in Brazil, institutional and procedural changes are needed in these areas, as outlined in the IMF’s recent technical assistance report, Supporting Implementation of the Expenditure Rule (English - Português), which was prepared at the request of the Brazilian National Treasury. In this context, approval and implementation of the proposed new Public Finance Law would be important to reinforce the new procedures.

Strengthening Medium-Term Fiscal Planning: IMF projections indicate that the spending cap will already become binding in 2018. In subsequent years, the fiscal pressure will increase further. This underlines the urgency to develop a fully-fledged medium-term fiscal framework to assess fiscal space and give a strategic orientation to fiscal policy. Looking at the fiscal framework more broadly, the rule by itself does not automatically guarantee fiscal sustainability. The IMF report cautions that absent other constraints, fiscal discipline could be at risk from increases in spending excluded from the ceiling, or by the increases in tax exemptions.

Monitoring and Compliance: The Treasury’s monthly reports have already begun discussing adherence to the rule throughout the year. In addition, its bimonthly expenditure and revenue reports include a discussion on how the rule will be met as fiscal projections evolve and sequestration (cuts to proposed spending) is applied.

Outside the government, institutions, analysts and the media will play an important role in monitoring implementation of the rule. The Independent Fiscal Agency is already engaging in a forward-looking fiscal policy debate about the impact of the rule in the medium and long term. It could leverage its attachment to the Senate to raise awareness in Congress about the challenges ahead. A formal compliance check will fall on Brazil’s external audit agency, the Court of Accounts. In all cases, clear and transparent communication with stakeholders in and outside the government and with the public will be important.

The time is right

If successfully implemented, the new rule will improve budget preparation, approval, and execution and make the budget more realistic. However, Brazil must forge ahead with its reform agenda amid global uncertainty. A recovery in commodity prices and favorable global liquidity conditions are playing in Brazil’s favor. Now is a good time for Brazil to advance reforms and restore the government’s finances.

1Fabian Bornhorst is the IMF’s Resident Representative in Brazil and Teresa Curristine is a Senior Economist in the IMF's Fiscal Affairs Department (FAD).

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.