Posted by John Stanford[1], Ross Smith[2] and Amon Dhliwayo[3]

Governments by nature are resistant to change, and when change occurs it normally is a slow, gradual process. Following this pattern, the uptake of accrual financial accounting and reporting initially moved slowly, after the drive to accrual began in New Zealand and Australia in the late 1980s.

However, times are changing. Within the next five years, it is expected that nearly two-thirds of governments will report on an accrual basis, according to a recent report by the International Federation of Accountants (IFAC) and the Chartered Institute of Public Finance and Accountancy (CIPFA). The report draws on the updated International Public Sector Financial Accountability Index.

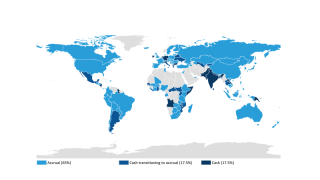

The 2018 Index Status Report captures information from 150 countries. It finds that while only 25 percent of governments currently report on an accrual basis, an additional 40 percent of governments are projected to migrate to accrual by the end of 2023. This upward trend is particularly marked in Asia, Africa, and Latin America and the Caribbean (see map). The high quality financial reporting guidance that the International Public Sector Accounting Standards (IPSAS) provide is at the core of these exciting developments.

Government Accounting Reporting Framework by End of 2023 (Click on the map for a better image quality)

Source: IFAC / CIPFA International Public Sector Financial Accountability Index: Data from 150 countries

Accrual reporting creates a strong base for good public financial management in countries that are well prepared for this reform. It also provides a comprehensive and transparent view of public finances that enhances the ability of citizens to hold governments to account for the use of taxpayers’ resources. And accrual reporting can be an effective tool for governments to manage and sustain the delivery of public services for generations to come.

Other highlights noted in the latest Index Status Report are that:

- More than half of governments that currently report on the accrual basis have either adopted IPSAS, or national standards based on IPSAS[4].

- Within 5 years, it is expected that almost three-quarters of countries reporting on an accrual basis will rely on IPSAS.

The report also highlights critical success factors for accrual reform projects. These factors include coordinated planning, committed and sustained support from politicians and senior policymakers, clear on-going communications, a change management plan, and effective training and capacity building programs.

IFAC and CIPFA are planning to expand the coverage and scope of the International Public Sector Financial Accountability Index, and to provide periodic status reports during the coming years.

[1] Technical Director, International Public Sector Accounting Standards Board (IPSASB), Toronto, Canada.

[2] Deputy Director, International Public Sector Accounting Standards Board (IPSASB), Toronto, Canada.

[3] Manager, Standards Development and Technical Projects, International Public Sector Accounting Standards Board (IPSASB), Toronto, Canada.

[4] Jurisdictions can adopt IPSAS directly, or indirectly by a national endorsement mechanism or through national standards which reference IPSAS.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.