iStock.com/z_wei

Posted by Fazeer Rahim and Claude Wendling[1]

Budget practitioners do not always see eye to eye. But they nevertheless can agree on several things. Here are some of them: the budget is the prime instrument for implementing fiscal policy; it is always good to keep a medium term and strategic perspective to budgeting (as opposed to day-to-day, incremental budgeting); incentives for ministries of finance and line ministries should be aligned as much as possible; and knowing more about future trends is always better than knowing less.

Projecting expenditure baselines over the medium-term is a key analytical exercise in budget preparation that can support many of these objectives. A recent How-To-Note published by the Fiscal Affairs Department (FAD) provides specific guidance on calculating and using baselines. The tool is found in many budget systems even if it is known under different names: spending baselines of course, but also forward estimates, no policy change estimates, or trend scenarios.

Broadly defined, baselines are estimates of what expenditure would look like if current policies remained unchanged over the medium term. They can serve as reference points against which proposed or approved budgets, or expenditure ceilings, can be compared. In more and more countries, they are becoming a key tool incorporated in the budget preparation process.

The importance of baselines has to do with the fact that, even if policies remain unchanged, the cost of delivering them can change. Costs may change due to variations in prices (e.g., an increase in public sector wages or in welfare benefits due to indexation mechanisms) and/or variations in quantities (e.g., demographic changes that affect the number of children in school or the number of individuals accessing welfare benefits). Costs can also change, relative to their current levels, when current policies are still being fully implemented (for example, a pension reform that progressively extends the retirement age) or when policies reach an end (for example, the completion of a mega infrastructure project) or when efficiency gains are gradually made.

Preparing baselines generates several advantages. Baselines can simplify budget negotiations between spending agencies and the Ministry of Finance (MoF) by allowing agencies to focus on new policies, or policy changes. They can provide early indications of spending pressures and their drivers. They can help authorities identify the fiscal space (positive or negative) that may be available to implement new policies. They can support more transparent fiscal policy as well as the public debate on fiscal sustainability.

While the concept of baselines is clear in theory, in practice it suffers from some ambiguity, as exemplified by the various competing definitions used globally. That’s why this new How-To-Note aims at establishing a generic framework that covers the various approaches to baseline estimation. It offers numerous country examples and approaches, ranging from advanced to low-income countries. Building on decades of FAD’s capacity development experience around the world, it provides step-by-step guidelines on how to prepare baselines, summarizes the key institutional set ups required, and the pitfalls to avoid. The Note also explains the peculiarities and challenges of preparing baselines for some expenditure types (e.g., how to be mindful of wage negotiations when setting wage baselines).

Many countries have tried to improve their budget practices by imposing a medium-term approach to budgeting, or by scrutinizing spending quality and effectiveness through spending reviews. Preparing baselines is a necessary building block for these reforms.

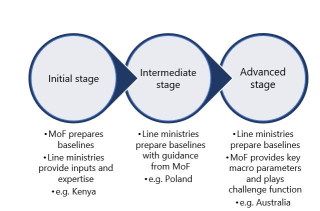

The How-To-Note also debunks a common misconception that the use of baselines in budgeting should be limited to advanced economies with mature budget systems. It explains how baselines remain a useful tool even in the context of annual budgeting by providing greater visibility over spending trends, identifying the fiscal space available for new policies, and allowing easier in-year monitoring of budget outturns. It also underlines, as shown below, that preparing and improving baselines can be an incremental process. In the chart, the respective roles of the ministry of finance and line ministries evolve step-by-step according to their level of experience and capacity.

Evolution of Spending Baselines

Budget practitioners interested in engaging with FAD on this topic can reach out to FADM1AST@imf.org or FADM2AST@imf.org

[1] Fiscal Affairs Department, IMF.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.