Meeting the Paris Agreement climate targets requires both more and more efficient public investment spending. Improving public infrastructure, including transport, water & sanitation, health, and education, is most important in this regard. “Green” infrastructure, i.e., infrastructure that supports climate-change mitigation and adaptation, is of particular importance. At the same time, there is also an urgent need to improve spending efficiency. Estimates by IMF staff suggest that, on average, around 35 percent of investment spending is lost or wasted during the public investment process, and that improvements in public investment management (PIM) can cut the efficiency losses by half. These losses reflect a number of issues—these may include different forms of corruption or bid rigging, and shortcomings in infrastructure governance, including weaknesses in project design, appraisal, selection, or execution—that will cause elevated costs and/or cost overruns.

Better PIM and especially better “green PIM,” makes government spending go further (“getting more bang for the buck”) and is key for improving the efficiency of investment spending. Climate change, and the related increases in infrastructure risks and uncertainties, add further to the urgency of improving PIM. Climate change drives up the efficiency losses from infrastructure spending that is carried out without taking climate change into account.

What options do governments have to strengthen their Green PIM? As a first step, they will need to get a comprehensive overview of their existing PIM institutions and their strengths and weaknesses.

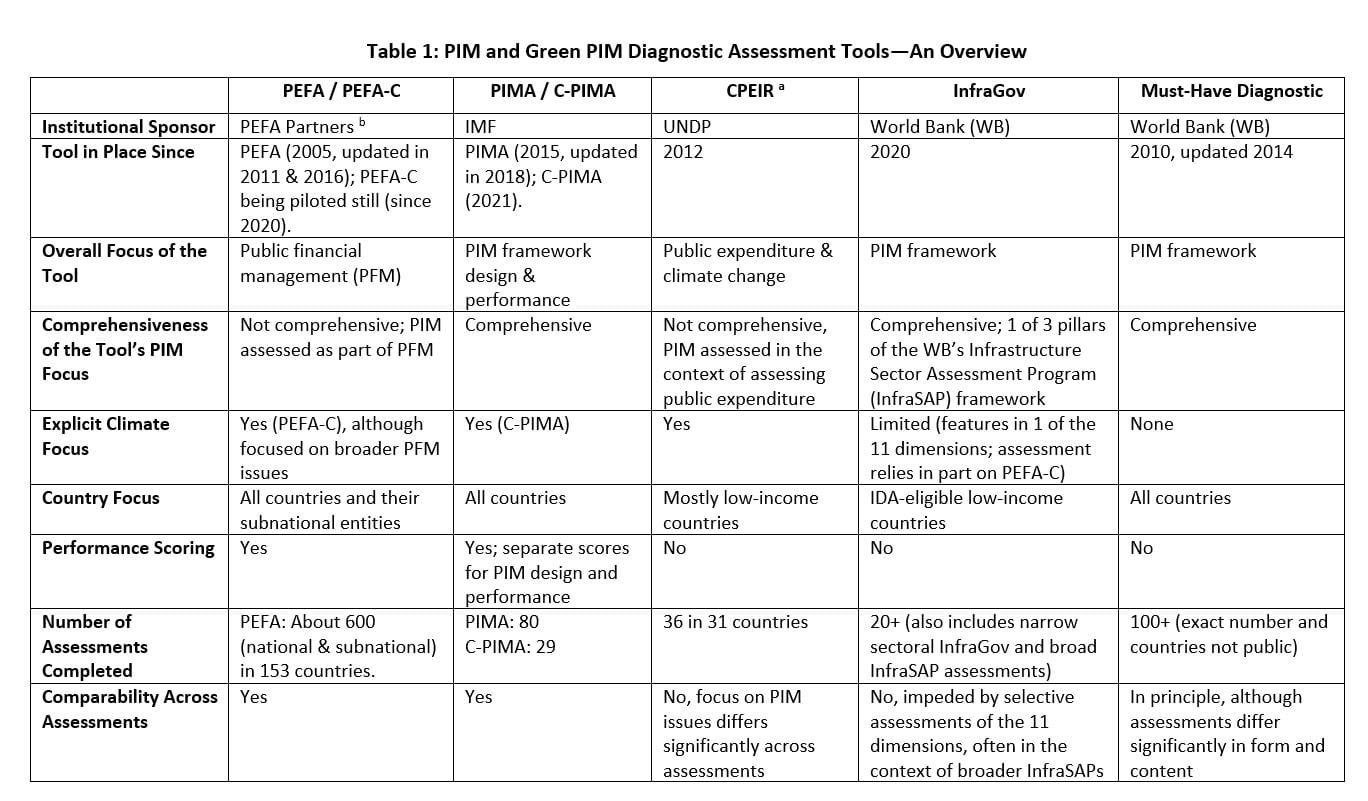

There are five assessment tools that help governments evaluate their PIM institutions. These are summarized in Table 1.

All five tools have in common that they assess institutions against a set of best-practice criteria, but they differ significantly in format, purpose, and scope. Only three of them (PIMA/C-PIMA, InfraGov, Must-Have Diagnostic) are dedicated PIM assessment tools that assess PIM in a comprehensive fashion, i.e., along the full investment cycle from project planning to implementation and operation. Only the IMF’s PIMA/C-PIMA “combo” assesses both PIM and Green PIM institutions and explicitly distinguishes between an institution’s formal setup (“on paper”) and its functioning (“in practice”).

The PIMA/C-PIMA views public investment processes as a “chain” that can only be as strong as its weakest link. That is, the efficiency of public investment is determined by the weakest parts of the country’s PIM institutions. For example, strong investment planning alone does not make for efficient public investment spending if implementation (e.g., procurement) is weak. Similarly, strong implementation does not make for efficient public investment spending if planning is weak. This approach naturally lends itself to identifying a country’s bottlenecks to achieving effective PIM.

`

Yet, there is no singular “best” assessment tool, and countries may wish to follow a pragmatic approach to identify reform priorities. Improving Green PIM institutions is particularly urgent, and a pragmatic approach would consist of “cooking with what’s available in the kitchen.” That is, in most countries, some PIM assessment may already exist, and, at least initially, reforms could focus on the key issues identified. For example, for improving “green PIM,” taking stock would include looking at all assessments available, be they a comprehensive C-PIMA, other assessments that have some Green PIM components (e.g., PEFA-C, InfraGov, CPEIR), or even assessments that have no explicit green PIM component (e.g., Must-Have-Diagnostic).

Still, lasting improvements can only be expected from sustained Green PIM reform efforts that go beyond quick fixes. Two aspects that are sometimes overlooked are particularly important:

- Green PIM reforms need to be well coordinated with broader PFM reforms. For example, reforms to strengthen a country’s medium-term fiscal framework (MTFF) have important implications for public investment planning. Similarly, improvements in public investment planning provide important data for MTFFs. Therefore, efforts to strengthen Green PIM institutions will need to consider the PFM reforms underway in country and those that are planned. Such coordination can often be complex, particularly if different levels of government or public entities outside of the central government are involved. For example, where SOEs manage large public assets and investment programs reforms to strengthen Green PIM will also need to consider how to improve the corporate governance structure of SOEs (e.g., the organization of their management boards and oversight of their financial performance).

- Green PIM reforms have important public investment elements themselves. A recent report by the World Bank’s (WB’s) Internal Evaluation Group (IEG) argues that WB support to PIM reforms in its IDA-eligible member countries was overly focused on prior actions in the WB’s budget-support lending operations and on providing technical support to define these prior actions. Effective support to longer-term institution building would also have required (i) helping to establish a clear upfront PIM reform vision; (ii) providing investment lending support for PIM institution building (e.g., for improving IT systems); and (iii) more programmatic technical support to PIM institutions along the full investment project cycle. The report suggests that project lending dedicated to improving PIM institutions, including both public investment and capacity development elements, would likely have yielded more lasting efficiency gains.

Source: Author’s compilation based on data from the IMF, PEFA, UNDP, and the World Bank. Main sources include https://0-infrastructuregovern-imf-org.library.svsu.edu/; https://www.pefa.org/assessments;UNDP (2022); and WB (2021).

Notes:

a. There exist several CPEIR “spin-offs,” i.e., frameworks, including UNDP-sponsored frameworks, that build on the CPEIR but have a somewhat different focus. An example is the UNDP’s Climate Change Financing Framework (CCFF). The information here refers to the original CPEIR framework, which is still in use.

b. Current PEFA partners are the WB, IMF, European Commission, and government agencies and institutions from 6 European countries.