When Sri Lanka was granted independence by the British in 1948, the country was considered one of the strongest economies in Asia. It is said that the mastermind behind Singapore’s economic success, former Singapore Prime Minister Lee Kuan Yew, in 1964 saw Sri Lanka as a role model and hoped that Singapore could be like Sri Lanka one day. Unfortunately, fiscal deficits – largely financed by debt and monetary financing - have played a large part in Sri Lanka’s recent financial problems. Lack of independence of Sri Lanka’s Central Bank has made many past governments comfortable with large fiscal deficits. Indeed, Sri Lanka has achieved a primary budget surplus only five times in the last 75 years.

Money is central to any economy as it is a medium to value products and services and to undertake financial transactions between various parties. It is of paramount importance that the value of money is prioritized and not used for short term gain. An IMF paper argues that for effective monetary and fiscal policies, it is important to have central bank independence. Evidence shows that independent central banks are generally associated with lower inflation and prevent a politicization of policy on interest rates.

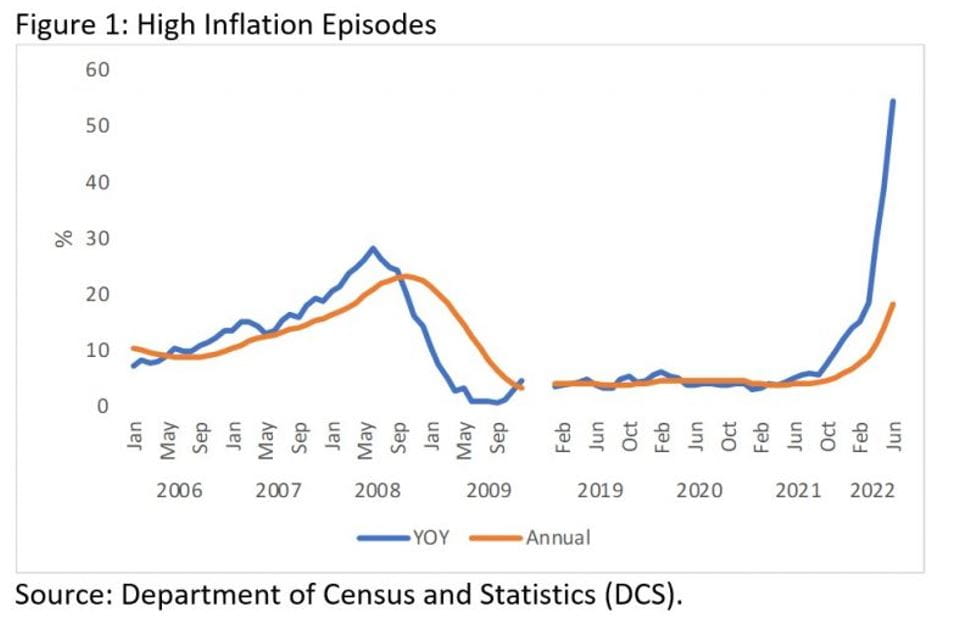

Prior to the passing of the Central Bank Act in Sri Lanka this year, the Bank came under the Monetary Law Act (MLA). The MLA gave the Central Bank independence to a certain extent in monetary policy formulation and complete freedom in drawing its budget. But it had its flaws. The Treasury Secretary was a member of the Bank’s Monetary Board and was able to influence the board’s decisions. The Bank was able to buy treasury bills from the primary auctions. The Bank’s three joint core objectives - economic stability, price stability and financial system stability – were difficult to align. In the 12 months leading to Sri Lanka defaulting on its external debt, a colossal amount of money was printed which was a key reason for inflation heading up to 70% in 2022 as shown in the chart below.

The new Central Bank Act that was approved by the Sri Lankan parliament fulfilled a key condition of the country’s EFF program with the IMF. The law brings many benefits. The Treasury Secretary is no longer a member of the Monetary Board. The Bank’s mandate has been clarified – its core objective is price stability with financial system stability a secondary objective. The Bank cannot purchase government securities from the primary market which effectively prevents monetary financing of the Treasury. It cannot grant credit to the government apart from state-owned financial institutions to ensure the stability of the overall financial system.

The Bank must agree with the Minister of Finance to set an inflation target under an inflation-targeting monetary policy framework every year. If the Bank misses the inflation target for two consecutive quarters, then it is required to submit a special report to parliament explaining the reasons. The new law includes other important features such as regular inflation reports and public statements following meetings of the monetary board.

The core objective of the Central Bank is price stability which should help keep inflation low and stable. A stable currency can drive in foreign and local investments and encourage savings. Low inflation will result in lower interest rates and help encourage growth in private credit and the economy. Lower market interest rates will also result in the Treasury being able to borrow money locally at a lower cost resulting in less strain on the fiscal balance.

In 2022, 78% of government revenue was spent on interest payments on Sri Lanka’s debt. Lower inflation can drastically bring down interest rates, easing Sri Lanka’s fiscal balance. It should also result in fairer taxation as taxes are laid out in nominal terms and tax brackets are not frequently updated in line with inflation. The IMF program currently in place requires Sri Lanka to achieve a primary budget surplus of 2.3% and reduce its gross financing needs to 13% of GDP by 2027.

Sri Lanka has one of the lowest government revenue to GDP ratios in the world at only 8%, with 70% of taxes being indirect taxes. The country also has a very narrow tax base. The Central Bank Act will result in the government looking at increasing progressive taxes to meet the IMF target of achieving a 15% government revenue to GDP ratio by 2025.

Overall, the Central Bank Act will result in increased independence of the Bank. Price stability and depoliticizing decisions on monetary policy can lead to a stable currency, lower interest rates, tax reform, stronger incentives for foreign direct investment, and improved long-term economic growth.