Posted by Teresa Curristine, Bruno Imbert, Fazeer Sheik Rahim, Vincent Tang, Claude Wendling and Laura Doherty [1]

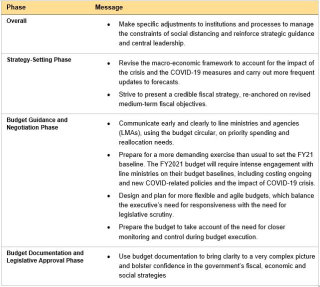

Since the COVID-19 pandemic erupted, governments have focused their efforts on short-term priorities and on designing and implementing immediate responses to the crisis. Most countries across the globe now need to turn their attention to the 2021 budget. A recently published IMF note discusses the challenges behind this difficult task, and offers general guidance on how to address these throughout the 2021 budget preparation cycle and beyond. In preparing the 2021 budget, countries will need to take stock of i) the impact of the COVID crisis including emergency measures on the economy and the government’s fiscal position; ii) evaluate the fiscal space available for continued priority spending and recovery measures; iii) assess the government’s financing needs; and iv) ensure transparent presentation and accounting for COVID-related fiscal measures. The general guidance in this note should be tailored to country-specific circumstances and existing PFM institutions and capacities. Table 1 summarizes the note’s main recommendations by the relevant phases of the budget preparation cycle.

An overall challenge will be to adapt institutions and processes as the FY2021 budget preparation process will require clear political and strategic guidance and adjustments to working practices to take account of the need for social distancing and other operational constraints.

Fiscal Strategy-Setting Phase: In setting the overall strategy for the 2021 budget, governments should recognize and adapt to the exceptional degree of macroeconomic uncertainty while preserving a medium-term orientation to planning and budgeting. Rather than focusing on a single macro-fiscal scenario, governments should consider outlining several scenarios. They could make policies contingent on these scenarios and envision more frequent revisions to their macro-fiscal framework. This phase will provide a first opportunity to reassess the impact of COVID-19 measures and to plan to put public finances on a firm footing. While looser and more flexible fiscal plans will be needed in the short term, governments should strive to present a credible fiscal strategy which is re-anchored on medium-term fiscal objectives and rules.

Budget Guidance and Negotiation Phase: Strong “top-down” guidance is needed under present circumstances. It is important that the Central Budgetary Authority (CBA) produce a well-drafted budget circular to guide ministries’ budget submissions. The circular should clarify processes, timelines and the fiscal constraints for the FY21 budget, clearly identify priority areas of spending, and the increased need for ministries to make proposals for potential reallocations and savings in non-priority areas. In setting ceilings and negotiating with ministries governments should prepare for a more demanding exercise than usual especially in setting the FY21 baseline. This baseline needs to reflect not only the impact of discretionary COVID-19 policy measures but also how the pandemic affects the cost drivers of other key government policies. Given fiscal uncertainties, the CBA may want to revisit expenditure within the baseline, limiting spending in non-priority areas, and encouraging bigger reallocations than usual. All this will require more time and engagement with ministries than usual. Contrary to what may have happened under the tight time pressure over FY2020, new spending measures will need to be carefully vetted by the CBA on feasibility and efficiency grounds.

Uncertainty is inherent to budget preparation, but under the COVID-19 situation, the degree of unpredictability is even greater than usual. In preparing the FY2021 budget, governments should anticipate budget execution constraints and ensure agility and flexibility. To ensure agility for FY2021 budget execution, potential tools include enhancing in-year budget flexibility mechanisms, adjusting in-year with supplementary budgets as the needs arise or creating/increasing contingency envelopes. The appropriate strategy will vary according to country-specific factors and the CBA must weigh the pros and cons of each flexibility tool and try to determine the best combination from the outset. It will also be important to ensure close monitoring of budget execution to support transparency and mitigate vulnerabilities to corruption. The context may also call for reserving portions of line ministries allocations subject to the macroeconomic and health situation during FY2021.

Budget Documentation and Legislative Approval Phase: Lastly, the budget documentation should convey the right message on the FY2021 budget and provide a complete picture on the announced policy measures and packages, notably by explaining assumptions and uncertainty in the fiscal and economic outlook, producing forward-looking guidance on financing as well as presenting the benefits and impacts for different groups in the economy. Governments are advised to continue their efforts to enrich information on gender, climate change, and UN Sustainable Development Goals.

Table 1: Main Messages for the FY 2021 Budget Preparation Process (Click on the table for a better image resolution)

This article is part of a series related to the COVID-19 Crisis. All of our articles covering the topic can be found on our PFM Blog COVID-19 Articles page.

[1] Teresa Curristine is a Deputy Division Chief, Claude Wendling, Vincent Tang and Laura Doherty are Technical Assistance Advisors and Bruno Imbert an Economist and Fazeer Sheik Rahim a Senior Economist, all in the IMF’s Fiscal Affairs Department.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.