Posted by Baoping Shang, Brooks Evans, and Zhiyong An1

The COVID-19 outbreak is expected to take a substantial toll on nearly all economies across the world (June WEO). Reflecting this, many countries have swiftly introduced a diverse range of spending measures to provide income support for households and to keep firms alive during the lockdown phase. As economies start to open up, these spending measures need to be geared towards facilitating recovery and building resilience against future shocks. This highlights the importance of designing spending measures to achieve policy objectives during different phases of the pandemic.

During the lockdown

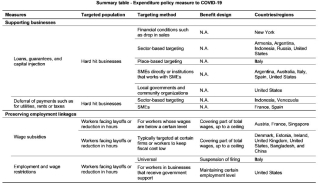

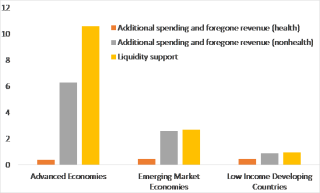

The fiscal policy responses to the pandemic have been unprecedented and the support to households, workers and firms has been substantial, particularly in advanced economies (Figure 1). Policies have been designed to achieve three main objectives during the lockdown phase: provide liquidity support to firms, preserve employment linkages and protecting vulnerable households (Table 1; IMF Special Series Note on COVID-19).

Figure 1. Fiscal Responses to the COVID-19 Pandemic (click on the figure for a better image resolution)

(percent of GDP)

Sources: National authorities; and IMF staff estimates.

Note: Data are as of June 12, 2020, covering a sample of 55 countries. The estimates are base simple averages.

Liquidity support for firms

Expenditure policy is more effective in delivering targeted support to firms particularly those hard hit by the crisis and those that are facing difficulties in accessing the financial system. Liquidity support can take various forms—such as direct lending, loan guarantees, capital injection and deferral of utility and rent payments—and it can help achieve various economic and social objectives. These include (i) keeping viable firms alive and preserve employment, albeit at reduced levels; (ii) facilitating post-crisis recovery by avoiding disruptive and costly bankruptcies and enabling quicker scaling up of output and employment as economies open up; and (iii) reducing the fiscal cost of other programs by reducing unemployment and public spending on other types of support. Liquidity support can be targeted in several ways including focusing on the most affected firms, on firms’ financial conditions, on the most affected sectors or locations, linked to firm size, or some combinations of these methods. Reaching the informal sector is always a challenge, particularly in emerging and developing economies.

Preserving employment linkages

The highly disruptive nature of the pandemic crisis, especially on the supply side, may make measures to preserve employment linkages particularly relevant. These measures should be temporary and time-bound, with the flexibility for extension if needed. These measures, such as wage subsidies and restrictions on layoffs, can help prevent the loss of firm-specific human capital, buffer employment and economic activity in the short term, and reduce social benefit spending pressures by preventing layoffs and claims for unemployment or social assistance benefits.

- Wage-focused measures (e.g., short-time work schemes) can be designed to be cost-effective and progressive as well as reinforcing solidarity. Various design options can be considered; however, it is important to keep in mind the fiscal cost, the need for administrative simplicity and the potential tradeoffs between efficiency and equity objectives. These schemes may cover part of compensation only for workers with wages below a certain level (Austria and Singapore). Alternatively, they can cover part of the compensation for all workers with a ceiling on the wage subsidy (Denmark, Ireland, U.K., and Bangladesh) and a special case is when there is no cap on the subsidy (Germany).

- Measures that are directly targeted at employment levels tend to be more distortionary as firms then have less discretion to set the optimal level of employment and wages. Employment restrictions can be used by themselves (Italy and Spain where layoffs related to COVID-19 were temporarily prohibited) or complement other policy measures to further restrict eligibility and lower fiscal cost (Denmark and United States where wage subsidies and liquidity support for firms were conditional on no layoffs or retaining employment at a certain level).

Supporting households, particularly the vulnerable and unemployed

Social protection systems, including both social insurance and social assistance, are central to providing income support to households during a crisis:

- Countries with well-developed social protection systems have strengthened them in various ways, including relaxing eligibility requirements (Austria, Canada, United States), increasing benefit levels (Australia, Belgium, United States) and extending the benefit period (Greece, United States).

- Emerging and developing countries with sufficient existing capacity have mostly prioritized the strengthening of social assistance programs, particularly through expanding coverage (Brazil, China, Indonesia and Colombia). In countries with weak capacity and existing social safety nets, alternative ways of supporting those not covered by existing programs could be considered, including cash transfers targeted at specific population groups (i.e., elderly, families with children, or informal sector workers in India and Bolivia) or regions (i.e., most affected areas), or subsidies for key goods and services such as food, health, transportation and utilities (Indonesia and Jordan).

- A possible approach to effectively reaching informal sector workers and other vulnerable households is to identify beneficiaries by using databases maintained by various government entities and private organizations or distributing benefits through local governments and community organizations (Rwanda, Nepal, Egypt and Peru).

- Universal transfer programs can provide a basis for strengthening the safety net, possibly only over the medium term because of the difficulties in ensuring adequate support for the most vulnerable at a reasonable fiscal cost. For countries with effectively targeted poverty-focused programs and fiscal space, universal (or near universal) benefits can be used to broaden income support for households beyond the vulnerable and stimulate aggregate demand (Hong Kong, Singapore, and the United States).

- The social distancing requirements have limited the scope for active labor market policies (ALMPs) such as public works and training. There may be circumstances under which these are feasible such as public works for disinfection/sanitation and online training (the Philippines, China and Estonia).

For the recovery and beyond

Countries have just started to consider measures to support the recovery. While during the initial lockdown phase, given the need to react quickly, economic incentives inherent in the support measures were less of a concern, these may become impediments to economic recovery. This requires support measures to gradually move away from saving firms and protecting jobs, to striking the appropriate balance between income support and work incentives, and to take into account the impact on aggregate demand:

- Phase out short-time work schemes and replace them with in-work benefits and hiring subsidies when cost-effective. The OECD has suggested that the winding down of job retention schemes should be coupled with new support to help people into work and support new hiring. The United Kingdom just unveiled measures to pay employers a £1,000 bonus per each reinstated furloughed worker and similar incentives to train and hire apprentices.

- Reduce the generosity of unemployment benefits if their replacement rates are too high.

- Strengthen policies for obtaining unemployment benefits. For example, training and job search requirements could be reinstated and the expansion of benefit periods rolled back.

- Target ALMPs (e.g., training, employment services and public works) at specific groups when cost-effective. There may be opportunities for public works to be directed at green jobs, such as reforestation.

- Prioritize measures that can help stimulate aggregate demand. Consumption vouchers have received much attention recently as many local governments in China introduced them to boost consumption. However, concerns have been raised on access by low-income households due to digital barriers and requirements for spending threshold. Investment in digital infrastructure and green investment have also been widely discussed, and some countries have taken steps (Malaysia and Luxemburg).

The crisis has exposed structural gaps in the social protection systems and efforts to address them are necessary to support the recovery and build strong and resilient social protection systems over the medium term. Many low-income and emerging market economies lack the capacity to reach, target and delivery benefits to those in need in a timely manner. Building such capacity would require (i) a comprehensive ID system to ensure inclusion and avoid fraud, (ii) integrating socioeconomic data to allow for effective targeting, and (iii) (digital) capacity for efficient benefit delivery. Some countries may achieve this by gradually refining programs that were introduced as “quick fixes” during the lockdown.

Table 1. Expenditure Policy Responses to COVID-19 Outbreak (click on the top and bottom parts of the table for a better image resolution)

This article is part of a series related to the Coronavirus Crisis. All of our articles covering the topic can be found on our PFM Blog Coronavirus Articles page.

[1] Economists, Fiscal Affairs Department

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.