Posted by Ali Hashim and Moritz Piatti-Fünfkirchen[1]

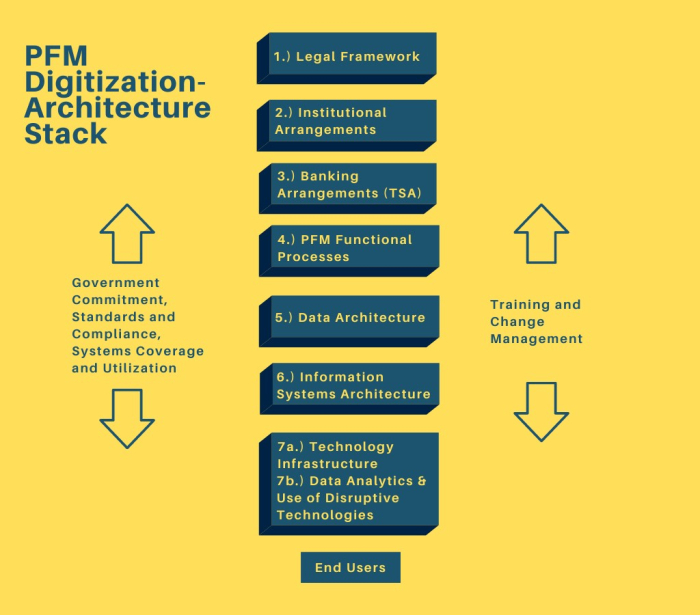

Digitization of processes in public financial management (PFM) holds a lot of promise. It can support efficiency, foster accountability and transparency, and ensure continuity of essential services during times of crisis. Countries are increasingly investing in aspects of digitization. However, how digitization relates to PFM is highly complex and requires an understanding of how a multitude of factors interact with one another. For this a “stacked layer model” can help.

Stacked layer models help simplify complex systems by breaking them down into their components organized by layers. A drill down into each of these layers provides the necessary detail on a system’s architecture and interrelationships. These models have been used extensively across disciplines, though not yet systematically in the area of PFM. In geo-spatial systems, for example, each layer provides specific types of information about the geographical terrain. In PFM digitization this concept could be used to map out essential layers, each of which provides greater detail on processes and relationships.

A PFM digitization stack layer can be visualized as follows:

The various layers involved in PFM digitization are as follows:

Layer 1: The legal framework that underpins PFM functional processes. This includes:

(a) the laws and regulations that describe the basic functions of budget management, budget execution, financial reporting, debt management and so on, and;

(b) the operational procedures and rules related to these various PFM functions, such as the structure of the chart of accounts, fiduciary and financial reporting requirements; and the accounting model.

Layer 2: The institutional framework: This includes the roles and responsibilities of the institutions entrusted with various PFM functions and their organizational structure.

Layer 3: Government banking arrangements and the payment systems architecture. This includes the architecture of the treasury single account and its interfaces with the banking system.

Layer 4: Major PFM functional processes. This describes the various functional processes such as macroeconomic forecasting; budget preparation; budget execution; accounting and reporting; debt and aid management; public procurement; revenue administration and auditing.

Layer 5: The data architecture. This includes information on the entities for which data is required to maintain and support the overall system.

Layer 6: The information systems architecture. This includes the IT modules required to support PFM functions, and the data flows between the systems;

Layer 7: Technology architecture and techniques for analyzing and transmitting data.

(a) Technology architecture. This is the infrastructure and technology platform required to operate the system and the information security protocols required to guarantee its integrity.

(b) Innovative techniques and disruptive technology for analyzing and transmitting data for better service delivery. These include smart cards and mobile money; block chains; robotic process automation; artificial intelligence and data analytics; and presentation tools (dashboards).

In addition to these layers, adequate functioning of a PFM system requires a suitable enabling environment and cross-cutting facilities. Major factors that determine a successful outcome are:

(a) Strong government commitment - necessary to drive change and address political economy issues;

(b) Adherence to standards;

(c) Training and change management; and

(d) Adequate system coverage and utilization.

A stacked layer model can help break down a complex system, such as the digitization of PFM, into its component parts. It illustrates the relationships among layers and external factors. This helps in understanding the working of the system and enables targeted interventions for better PFM reform outcomes. The model could have many potential applications in digitizing PFM systems.

[1] Ali Hashim is a former Lead Treasury Systems Specialist and Moritz Piatti-Fünfkirchen is a Senior Economist at the World Bank.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.