iStock.com/AlexLMX

By Anja Baum, Paulo Medas, Alberto Soler, and Mouhamadou Sy[1]

State-Owned Enterprises (SOEs) are present in most countries around the world, operating in core sectors of the economy and providing public services. They operate mostly in sectors such as public utilities (electricity, water), energy, transportation and banking but are also found in manufacturing and trade. Among developing economies, they are central players in providing essential infrastructure for economic development.

Their large economic footprint too often comes with significant challenges. Our recent IMF study discusses how governments have struggled to ensure that SOEs perform efficiently while delivering on their public mandates. In part, this reflects that government’s policy mandates often lack transparent and are not appropriately funded. As a result, SOEs have struggled to operate efficiently and under deliver on their policy mandates (e.g. providing reliable electricity at affordable prices). Many perform worse than private firms operating in similar sectors. Many have high leverage and arrears, making them more vulnerable to adverse shocks. Also, managers are willing to take larger risks under the expectation they will be bailed out by government if they face financial problems.

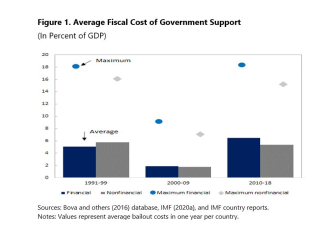

The struggles faced by SOEs inevitable end up, directly and indirectly, impacting government budgets and balance sheets through lower revenues, higher transfers and contingent liabilities. For example, based on a sample of 80 countries, the average fiscal cost was above 5 percent of GDP in the 2010–18 periods. Our research highlights that more needs to be done to improve monitoring of SOEs and their associated fiscal risks as a core element of overall good fiscal and risk management. In many countries, governments still lack comprehensive and timely information on SOEs operations and the tools to fully analyze the risks to the government’s budget.

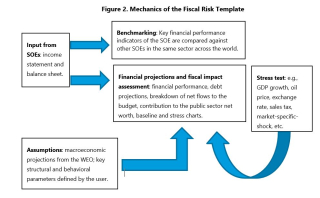

To help governments, we developed a new excel-based tool to strengthen monitoring of financial and economic performance of individual SOEs and possible fiscal risks for governments. The idea is that countries should (i) be able to compare the performance of an SOE in a given sector with its peers in other countries; (ii) assess the financial health of the firm in a baseline scenario and possible implications for the government’s budget; (iii) quantify potential fiscal risks under different stress scenarios—allowing to assess how vulnerable the firm is to adverse shocks.

Specifically, the fiscal risks template allows users to:

- Benchmarking across 86 sectors and sub-sectors, as well as by countries income level. This comparison provides an indication of potential weaknesses if an SOE performs systematically worse than its peers across countries.

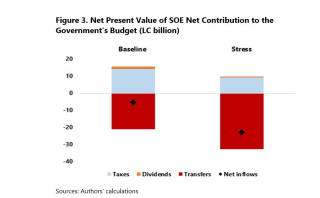

- The baseline and stress test scenarios provide projections of financial indicators and budget impact. Financial indicators are grouped by profitability, liquidity, solvency, and operating efficiency. SOE financing needs and the possibility of meeting them through government’s transfers are also calculated both under the baseline and the stress test scenarios.

In sum, the template allows users to identify, and quantify under different scenarios, fiscal risks before they materialize. In this way, governments can take action to address the main vulnerabilities, including by going through a detailed analysis of the firm and the need for reforms. The results of the template can also provide inputs for annual budget preparation and medium-term fiscal planning, including more generally when assessing the adequate size of fiscal buffers to manage risks.

[1] Anja Baum is an economist at the IMF Middle East and Central Asia Department, Paulo Medas is Chief of the Fiscal Policy Division in the IMF Fiscal Affairs Department (FAD), Alberto Soler is a senior economist in FAD, and Mouhamadou Sy is an economist at the IMF Asia and Pacific Department.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.